We have all seen them, disguised under a number of names: processing fees, service charges, or – probably the most offensive of all – “convenience” fees. Whatever you want to call them, your customers universally and understandably resent them. No business should set out to intentionally irritate its customers, and junk fees will in many instances backfire, eventually preventing the finalization of sales.

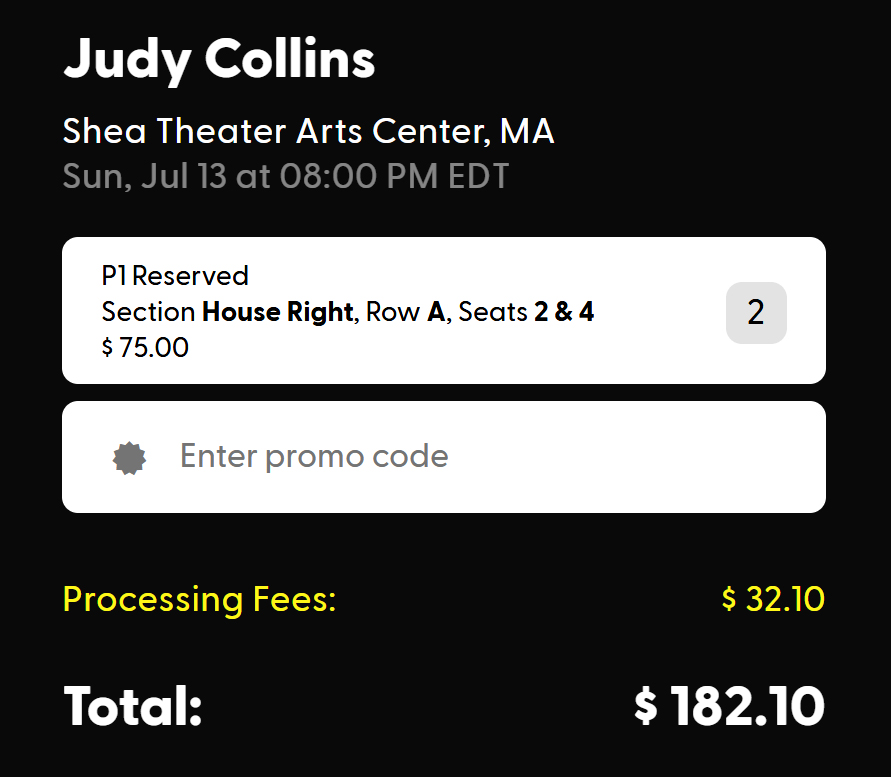

The airlines and online ticket vendors for sporting events and concerts have been notorious for their abuse of add-on junk fees, inflating the actual prices for their services. Serious attempts at controlling these fees in the interest of consumer protection were made during the Biden administration, but consumer interests are being thrown out the window under the second Trump administration, as evidenced by the dismantling of the Consumer Financial Protection Bureau. The status of either the laws or their enforcement does not affect consumer attitudes, where nobody likes to feel that they have been “ripped off”. As an example, tickets went on sale recently for an upcoming concert at a small nearby venue. I was willing to pay $75.00 each for front row reserved seats; however, the $32.10 in “processing fees” was outrageous and killed the sale. Maybe somebody else paid the fees and the concert will be sold out, but there is a point where all potential customers will say “enough is enough” and where seats will go empty and business will be impacted.

From a business owner’s perspective, it is always important to control and account for costs. If the prices that you charge do not exceed your costs of doing business, your business will not be profitable and will sooner rather than later fail. All the costs that come into play in your company’s accounting and tax preparation must be covered. These include your costs of labor, insurance, vehicle expenses, infrastructural improvements, repairs and maintenance, taxes and licenses, legal and professional services, mortgage payments, interest on loans, depreciation, supplies, and other expenses. Those other expenses for businesses these days now include credit card processing fees and the fees charged by your reservation services provider.

For a campground, all those costs of doing business come into play when determining the cost of an overnight campsite or rental. You will understandably charge more for a 50-amp full hookup site than you do for a primitive tent site, taking into account not only the costs of the infrastructure but also the anticipated utility usage. That is an example of building the costs of doing business into your price structure, and your customers understand and fully accept the concept. On the other hand, let’s say that you purchase a new fleet of vehicles or build a new on-site manager’s residence. Your guests would never accept a surcharge on top of your usual fees for that added overhead. Unless you want to discover the threshold where your customers “just say no”, you will build those expenses into your basic price structure along with every other cost of doing business.

With that in mind, I do not understand why so many campgrounds think that their customers will find it acceptable to pay add-on fees for online reservations or their use of a credit card, which is usually the only way to pay for an online reservation. The campground industry works diligently to position itself within a more upscale environment, comparable to other segments of the lodging and travel industries, hence the embrace of the “outdoor hospitality” moniker. Well, if you have stayed at a major hotel chain or booked a cruise, with few exceptions you have not been charged a fee for use of a credit card when making your reservations. A notable exception is Carnival Cruise Line which imposes a credit card surcharge of 1.1% for use of Visa or MasterCard or 2.75% for use of American Express for direct booking through their website or call center (with no surcharge for debit card payments). Hilton Hotels is also said to be exploring the concept of credit card fee surcharges. The bottom line is that getting away with charging these fees does not make the practice the right thing to do or something that customers find acceptable. Adding these credit card surcharges is actually illegal in Massachusetts, Connecticut, California, and Puerto Rico; however, many merchants and merchant associations have circumvented the intent of the laws by offering so-called “cash discounts”. Simply because something is legal does not make it right. Do you want summary statements to be given to your guests at the time of checkout looking like the typical monthly utility bill, with line after line of vague surcharges? We are living in difficult times for consumers, and my advice is that this is no time to play games with loyal customers but rather a time to treat them with the respect that they deserve.

This post was written by Peter Pelland